(SS) Strong Setups Series - 1

A lot of People ask me -"How to locate a Trade setup !!" I always tell them, setups are everywhere, which can be traded also, but one should wait for a Strong trade Setup! That is more important !

Now the question is still Open -

Which setups are Strong?

--This can't be put in a single post, so will try to explain in a series of posts.. Kindly have patience & go through with me in this whole journey, you will find it interesting & profitable too ! It will be written taking into consideration of novice traders with basic knowledge. I will try to analyze the live market setups (positional with the system). Lets see how it unfolds --

Lets start from a different angle- Traders.

Every Trader is different. Each trader is unique with Unique personality, monetary needs, different trade size, risk capacities, Psychology, Fear levels, satisfaction levels, indicators & so on.

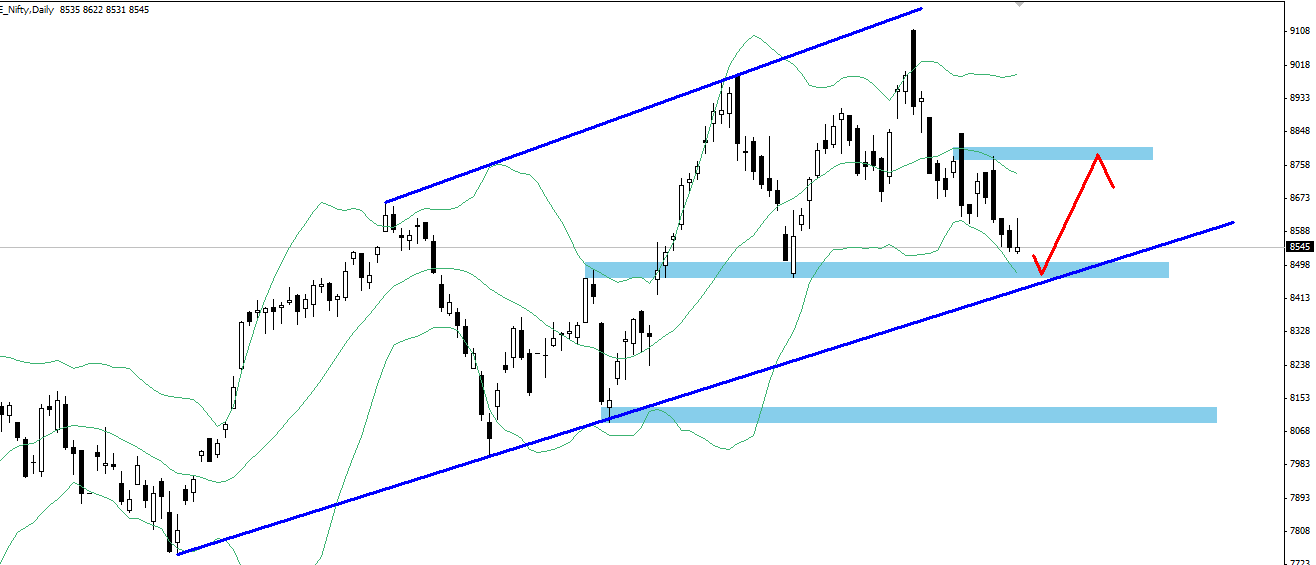

Remember, every damn indicator can work & works, if followed properly. But, every indicator has certain conditions to work. One needs to master few of them only, not over analyzing & paralyzing their decisions.. Look at the chart below with most important & trusted indicators (current Daily Chart of Nifty) if we can conclude the decision-

1) Nifty above all moving averages & EMAs (important ones) - means UP/ Sideways (in case 1 MA is above)

2) MACD yet to cut down - means UP

3) RSI coming down from overbought zone - DOWN

4) Stochastic clearly DOWN

5) Trendlines - UP

6) Patterns - Rising Wedge - DOWN, a small inverse H&S - UP & with a target

7) Price action - Higher Highs, higher lows - UP

so which will work & constitute Strong Setup ? get off the screen & Think for a while below things-

1) Can all indicators/ patterns tells truth?

2) Are indicators really important?

3) Do they Lag?

4) Do we need 1 / 2 or 5 indicators along with PA, trendline...?

----------------------------------------------------

I will come straight to the point -

1) Can all indicators/ patterns tells truth? - Yes, they need to get Interpreted properly. One should use indicators as per traders personality - Example - I use & Love Bollinger Bands

2) Are indicators really important? - for Positional definitely need to see few & good tool for conformation in Intraday also

3) Do they Lag? - may or may not - like Bollingers & RSI - they don't lag as much as people says.

4) Do we need 1 / 2 or 5 indicators along with PA, trendline...? - One or at the max 2 are enough for use.

Remember, Indicators tell a lie, but they don't lie together!

Anybody can go ahead with any indicator/ without indicator, but i would like to continue this journey with

Price action & Bollinger Bands !!

to be continued..